📈 Stock Insights: Your guide to unlocking stock market potential! 🚀📊

💡 Get exclusive tips & analysis on stocks 📈

🌐 Stay updated on market trends & news 🗞️

📚 Learn strategies for successful investing 📚

💰 Unlock your portfolio's growth potential 💼

🔒 Join our premium community for valuable market insights! 💎

StockMarket | Investing | FinancialEducation

14 posts

Is PayPal Undervalued

Trading at historically low 28x P/E and 5.57x Gross Profits.

$pypl has been trying to compete with Stripe and Adyen by adding new payment methods.

07/05/2023

My Favorite Dividend Stock

My favorite dividend stock pays a massive 21% yield! And it has a super low valuation of 2.3 P/E!

Why? The company is the energy giant Petrobras. It is based in Brazil so international investors value it much less. After the left-wing candidate Lula de Silva got elected as president, the stock tanked on fears of more energy tax. There... Read more

06/15/2023

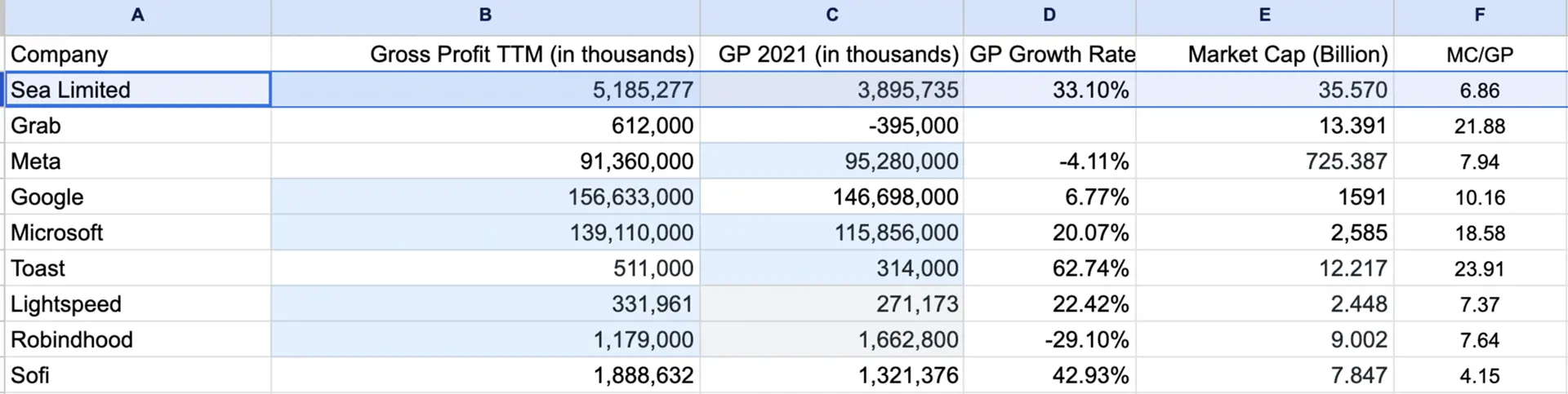

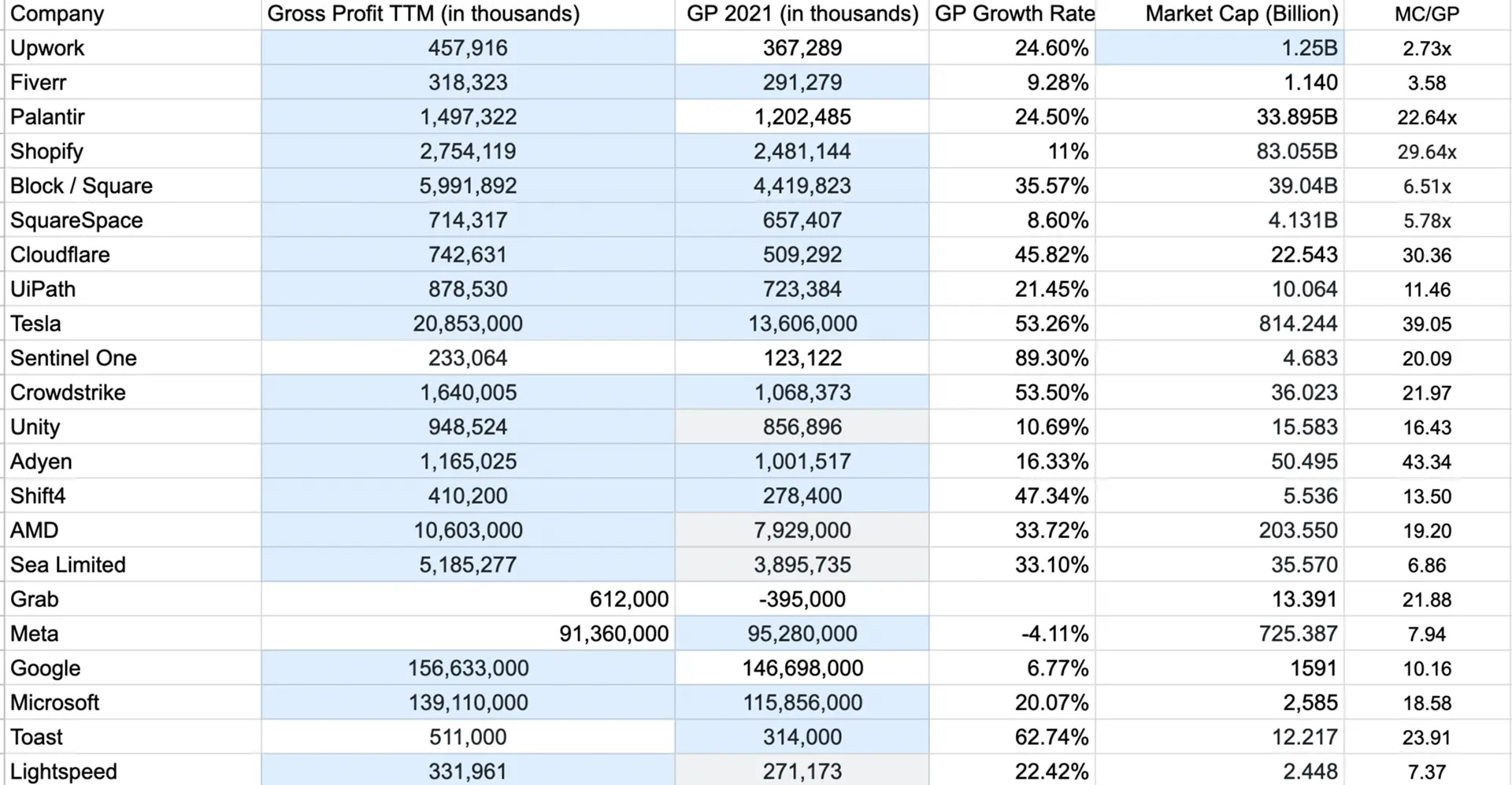

Tech Valuation Based on Gross Profits

I pick gross profits because some companies have high costs associated with their product. For example payment processors pay high fees to visa/mc and their banks. Their revenue might be high but their costs are hight too. Same with E-Commerce store.

Which companies do you like more?

06/15/2023

💥 Nvidia's Remarkable Rise

❗️ Significance of Nvidia's Success: Nvidia's performance highlights the accelerating influence of... Read more

05/29/2023

📰 Market Update

US stock futures are on the rise as optimism surrounding a debt deal takes hold. Investors are relieved as the United States and its creditors reach an agreement to raise the debt ceiling, averting a potential default and its economic repercussions. As a result, market sentiment is positive, leading to an uptick in stock futures.

Meanwhile, the dollar remains subdued... Read more

05/29/2023

Investing in Blue-Chip Stocks: Stability and Growth

Blue-chip stocks are shares of well-established companies with a history of stable earnings, strong market presence, and reliable dividends. Here's why they are often considered attractive investments:

a) Stability and Reliability: Blue-chip companies have a proven track record of weathering economic downturns and maintaining stable earnings even in challenging times. For example, during the 2008 financial crisis, stocks like Johnson... Read more

05/26/2023

The Role of Economic Indicators in Long-Term Investing

Economic indicators provide insights into the overall health of an economy and can influence investment decisions. Here are a few key indicators and their impact:

a) Gross Domestic Product (GDP) Growth: GDP represents the total value of goods and services produced within an economy. Positive GDP growth indicates economic expansion and can drive stock market performance. For example, during periods... Read more

05/26/2023

Exploring International Markets: Diversifying Beyond Borders

Investing in international markets can provide opportunities for diversification, exposure to emerging economies, and access to industries that may be underrepresented in domestic markets. Here's what you need to know:

a) Diversification Benefits: Investing internationally allows you to spread risk across different countries, currencies, and economies. When one market underperforms, others may thrive, reducing the impact on your overall portfolio.... Read more

05/26/2023

Identifying Value Stocks for Long-Term Investing

Value investing involves identifying stocks that are undervalued relative to their intrinsic worth. Here are some strategies to consider:

a) Assessing Intrinsic Value: Look for stocks trading below their intrinsic value by analyzing factors like earnings potential, book value, and cash flow. Warren Buffett's investment in Coca-Cola (NYSE: KO) in the late 1980s is an example of successful value investing,... Read more

05/26/2023

The Importance of Research: Analysing Financial Statements

Knowledge of financial statements is vital for evaluating the financial health of companies and making informed investment decisions. Key financial statements include the income statement, balance sheet, and cash flow statement. Let's explore their significance:

a) Income Statement: The income statement provides a snapshot of a company's revenue, expenses, and net income over a specific period. By analyzing revenue growth,... Read more

05/26/2023

Spotlight on Promising Industries for Long-Term Growth

Today, let's shine a light on industries that show immense potential for long-term growth. While no investment is risk-free, understanding emerging sectors can help identify promising opportunities. Here are a few industries to consider:

a) Renewable Energy: The renewable energy sector has witnessed significant growth due to increasing global concerns about climate change. Companies involved in solar power, wind energy,... Read more

05/26/2023

Understanding the Basics of Long-Term Investing

Let's explore the fundamental principles of long-term investing. Long-term investing involves holding investments for an extended period, typically years or even decades, with the goal of achieving significant growth over time. One key principle is the power of compounding, where your investment gains generate additional returns. For example, a $10,000 investment with a 10% annual return can grow to approximately... Read more

05/26/2023